Since the end of August 2015, the European Commission has held a public consultation to determine whether and how the directive around taxes on alcoholic beverages should be adopted to reduce fraud and abuse. The consultation is closing November 27th.

The consultation of the Committee is part of the “Better Regulation” agenda, through which the EU wants to simplify rules and regulations to reduce administrative costs and improve consumer protection.

The existing directive on the harmonization of the Alcohol Excise Structures Directive (92/83/EEC) has been around for more than 20 years, and categorizes alcoholic products in a way that all member states use the same definitions. In addition, it prescribes a method to calculate excise duties and determine which products qualify for reduced rates or exemptions.

Pierre Moscovici, Commissioner for Economic and Financial Affairs, Taxation and Customs said: “Current rules on the classification and excise structure of alcoholic beverages can be open to interpretation, so that some producers can exploit tax loopholes by producing and selling counterfeit alcohol. By taking part in this public consultation, interested parties and consumers can have a real impact on reducing fraud in this area. We also want to look at ways to lighten the burden for our smaller producers.”

Several NGOs in the alcohol field have informed the Commission that the current classification of categories for alcoholic beverages is unclear. Additionally, they have argued that reduced rates and exemptions are undesirable from a health point of view.

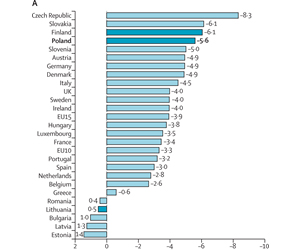

STAP, the Dutch Institute for Alcohol Policy, argues that simplification of the regulatory classifications can be achieved by moving to a progressive system of taxation based on the alcoholic content. In this classification, the higher the alcoholic content, the higher the rate per volume percentage of alcohol. This system is clear and easy to implement.

For more information on the consultation and excise duties on alcohol, click here>>

For the reaction by STAP on the public consultation, please look here>>

For the more international reaction from our friends at IOGT-NTO and ACTIVE, please look here>>

For the consultation itself, please click here>>